Trump tariffs impact: Is a US recession likely and does India need to worry about it? – The Times of India

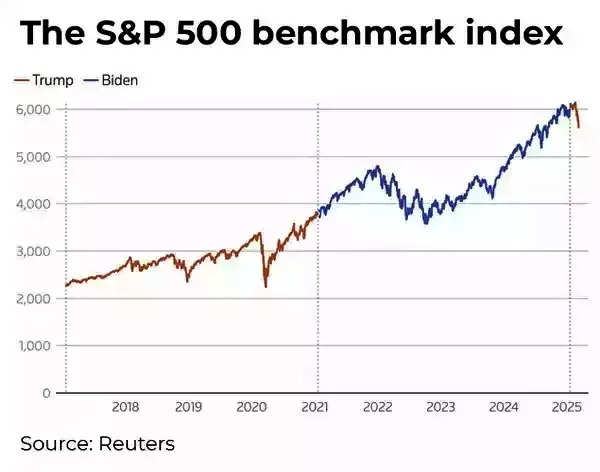

It’s mayhem in US stock markets! The S&P 500 has plunged more than 10% since its highest level which was seen last month. The turbulence is being caused by US President Donald Trump’s trade war and economists are watchful on how much pain the US economy will have to bear. Fears are ripe of a US economic recession and there is also talk of a stagflation-like scenario where GDP growth stagnates and inflation is high due to the tariffs. In such a scenario, where does India stand? What will high US tariffs and America’s economic slowdown mean for India? We ask experts and dive into India’s GDP growth prospects, and exposure to US tariffs.

Trump’s self-declared trade war is being seen by economists as a challenge for the US economy as it could result in higher prices, slower growth and fewer jobs. This uncertainty surrounding the future prospects of the US economy comes after it showed resilience during the COVID pandemic. Indeed, the US has been seeing a phase of ‘global outperformance’ according to a Reuters report, with GDP growth above trend and inflation consistently on the decline.

“There is a period of transition because what we’re doing is very big — we’re bringing wealth back to America,” Trump told Fox News on Sunday.

S&P 500 benchmark index

Sachchidanand Shukla – Group Chief Economist, L&T is of the view that the timing and sequencing of Donald Trump’s tariff moves has taken everyone by surprise even though Trump and tariffs were supposed ‘known-unknowns’.

“Most expected him (Trump) to target China first, but he announced 25% tariffs on US allies like Mexico and Canada and only later applied 10% tariffs on China. Also, with all the uncertainty around tariffs and the impact on the economy, people tend to postpone consumption, investment and trade decisions, which can impact the real economy,” he tells TOI.

What’s the likelihood of a US recession?

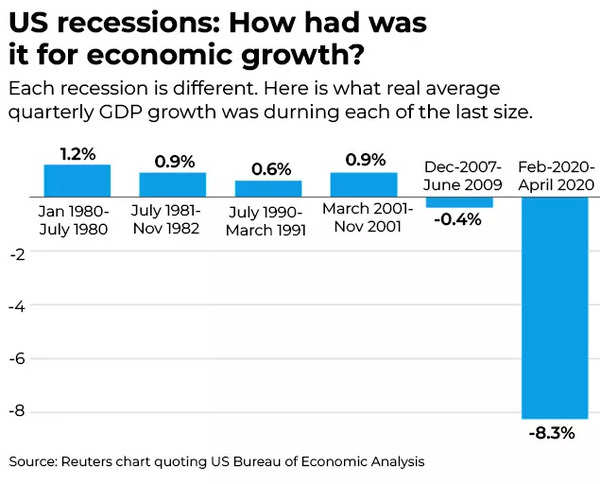

Recession happens when the Gross Domestic Product (GDP) of an economy comes down in a meaningful way. Usually, if the GDP of an economy contracts for two quarters in a row, it is seen as a recession. Historically, recessions are costly, with the pain of the contraction not being uniform.

US recessions

According to a Reuters report, a US recession may be caused by the ongoing volatility in sentiment, the stock market crash, and a dip in activity to Trump’s tariff moves changing the global trade.

Diane Swonk, chief economist at KPMG told Reuters that a US recession by the beginning of next year cannot be ruled out. “A price shock on its face, the tariffs could also begin to kill demand,” she was quoted as saying. Diane Swonk said that if consumers are wary of spending, firms face uncertainty on investment and hiring, then it would have an impact.

DK Srivastava, Chief Policy Advisor, EY India sees the likelihood of the US economy going into a significant economic slowdown if not an outright recession as quite strong. “The main reason for this would be the expected adverse impact on aggregate demand due to various cuts in the government programmes and salaries to government employees being currently implemented in the US,” he tells TOI.

However, Srivastava says that a US economic slowdown is likely to be only for a limited period. “As cost cutting measures take effect, particularly the expected fall in energy prices both domestically within the US and globally, the US economy should start to gradually improve,” he says.

Madan Sabnavis, Chief Economist, Bank of Baroda says America is unlikely to get into a recession. Tariffs introduced by the Trump administration are more a tool to encourage local production if it works, Sabnavis told TOI.

“The result could be higher inflation if taken to the logical end. That can affect demand at the limit. However, this may not really be expected to fructify as the government will be monitoring the flow of goods and services,” he says.

“If other countries do lower tariffs, it can boost US exports on the other side. Hence, prima facie, I do not think a recession looks likely in the USA as of now though one has to see how things work out on the tariff front,” he adds.

Why is the Trump government not worried?

The Trump administration doesn’t appear to be worried about the possibility of a US recession. While Trump himself has said that the US economy is in ‘transition’ his team has spoken of ‘detox’. US Commerce Secretary Howard Lutnick has even said that a US recession would be ‘worth it’ to make sure that Trump’s policies are in place.

Sachchidanand Shukla notes that from recent statements by Trump and his advisors, it appears that they are willing to take short-term pain for the economy, even if it means the US economy going into recession with the focus being the ‘Main street as opposed to Wall Street’ in the medium term.

“Trump himself has hinted at a ‘period of transition’. It is believed that the idea of the Team appears to be to frontload the pain so that any pain can be blamed on the earlier administration and once the economy recovers, later during Trump’s tenure, they can take credit for it. So, a recession or a Wall Street crash is not a big concern for them right now,” Shukla believes.

Does India need to worry?

Indian stock markets have seen a big correction in the last few months – with BSE Sensex plunging almost 14% from it’s all time high of nearly 86,000. Various reasons have been cited for the stock market crash – from the market being overvalued to slower than expected GDP growth in the second quarter, RBI’s tight liquidity, and the global economic uncertainty post Trump’s tariff moves.

However, a recent report by Morgan Stanley suggests that Indian stock markets look attractive for the long-term. Morgan Stanley has even retained its year-end Sensex target of 105,000. “A likely positive shift in fundamentals is not in the price – we expect India to recover lost ground against its peer group through the rest of 2025,” Ridham Desai, Equity Strategist at Morgan Stanley has said.

The Indian economy is the world’s fastest growing major economy, and it is expected to continue holding that title in the years to come, as per IMF forecasts. The world’s fifth largest economy saw its GDP growth slow more than expected to 5.6% in the second quarter of FY2025. However, economists point to a quick recovery with the recently released GDP data showing 6.2% growth in Q3 FY25.

Madan Sabnavis says that with regards to India there are two concerns; “First, if we do reduce tariffs on US imports, domestic industry can be impacted. Second, on account of higher tariffs on Indian goods, the US may source from other markets thus affecting our exports. The latter is more of a concern right now as the US is our major export destination,” he says.

L&T’s Group Chief Economist is confident that India will likely retain its tag of the fastest growing major economy. “From India’s point of view, our linkages to the US are far lower on trade. We don’t export or import in high numbers as some other large exporters to the US,” Shukla explains.

“But, what a US economic slowdown will do is it will impact the dollar denominated flows to India – both in terms of portfolio flows and FDI. The currency will also take a hit, which in turn would hit the Indian economy,” he cautions.

EY’s DK Srivastava points to the fact that the Indian economy has already been facing significant uncertainties on account of global slowdown and supply chain disruptions. “This adverse global impact is likely to be further accentuated with US tariff revisions and impact on exports from India to the US, particularly related to exports of goods,” he says.

However, he believes that policy makers in India should largely be able to neutralize this impact by stimulating domestic demand. “In fact they should continue to rely on government infrastructure expansion which has relatively larger multipliers. India should also benefit from the expected lower global energy prices,” he says.

Sachchidanand Shukla points out that in a world struggling for growth, India stands out. “China is seeing deflation, Europe has its own issues – a 6-6.5% growth for India seems achievable. India has been making necessary changes to fiscal policy by way of sprucing up its spending level with capital expenditure back on track. On the monetary side, the RBI has begun cutting rates and has infused liquidity and that cycle is likely to continue. Both fiscal and monetary policies are now working to keep the Indian economy on track, so I believe we are relatively better placed than other major economies to deal with US economic disruptions,” he concludes.