Is a US recession coming? 7 charts that show the plight of the American economy – The Times of India

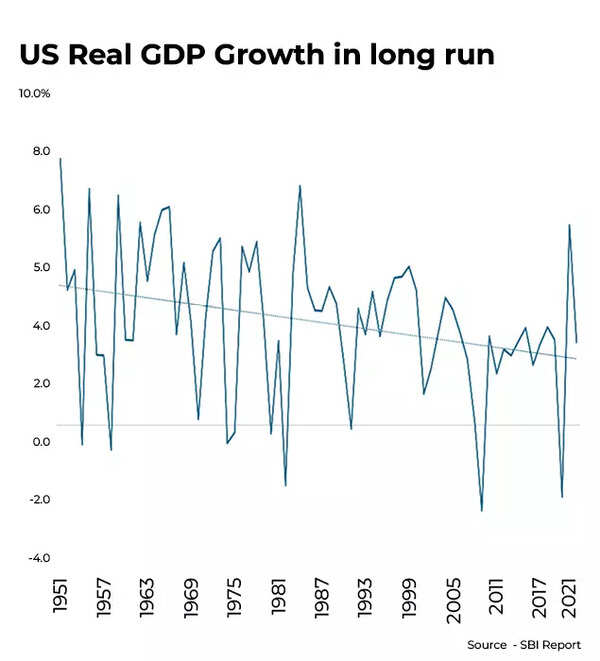

Is the US economy headed for a recession? A recession happens when an economy’s GDP contracts for two consecutive quarters. A recent SBI Research report shows that the long term US GDP growth shows a declining trend.

Concerns have risen about the economic outlook of the US post Trump’s tariff measures and cutting of spending and jobs. Economists view Trump’s trade conflict as a potential threat to the American economy, with possible consequences of increased consumer costs, reduced economic growth and diminished employment opportunities.

“The trends indicate that the jump in US economy post COVID may have been an outlier as a result of policy extravaganza…. Long trends indicate possible downturn in US economy,” says SBI in its latest report.

US Real GDP growth in long run

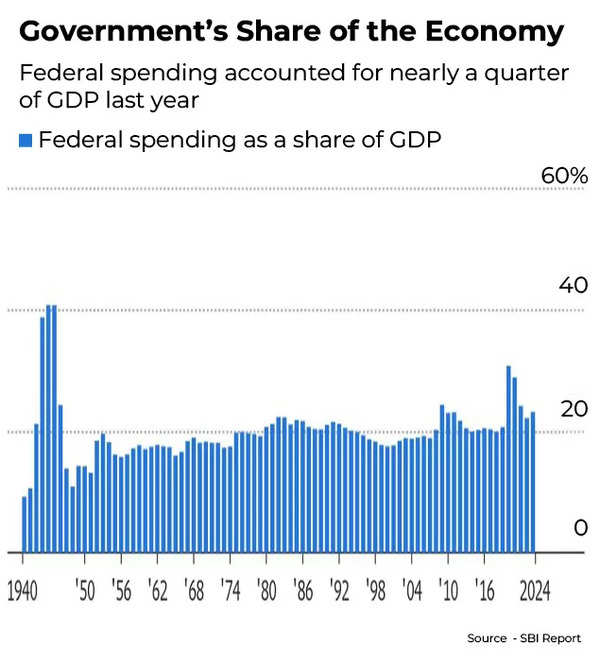

The report also cautions that, “the zealotry mission of departments like DOGE can undo a lot of ground works done in the previous decades, putting downward pressure on the beleaguered economy.” DOGE or the Department of Government Efficiency is an initiative of the US President Donald Trump and is headed by Tesla CEO and Trump advisor Elon Musk.

Drastically cutting Federal spending can be disastrous, says SBI report

The economic uncertainty looms large, particularly noteworthy as it follows a period when the US economy demonstrated remarkable strength whilst managing the COVID pandemic crisis. So is the US economy headed for a recession? We take a look at some important data pointers in the SBI report on and the expected trends in the US economy based on long-term history:

What US economic data is pointing to

1) GDP growth trajectory: Analysis of US GDP growth reveals a downward trajectory, particularly evident since 2000, says the SBI report. America’s economic indicators suggest a reduction in potential GDP, alongside weakening demand and investment patterns.

The US economy has weakened over the past year, with GDP growth declining from 3.2% in Q4 2023 to 2.5% in Q4 2024, notes the SBI report.

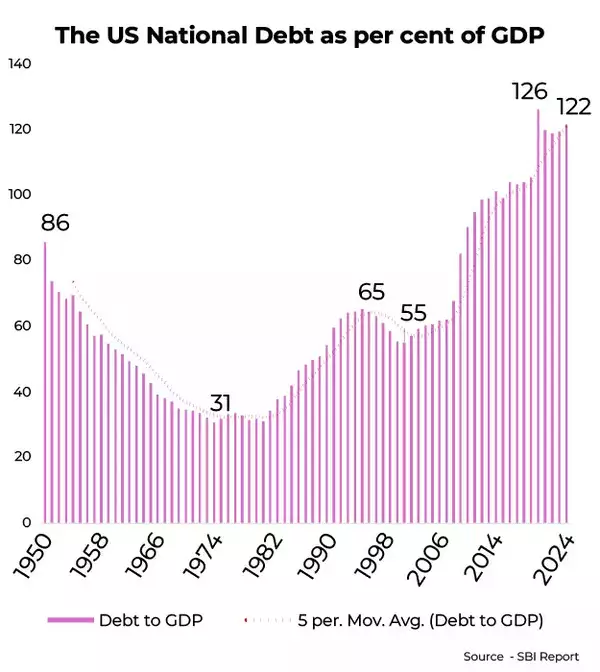

2) Debt: Rising national debt levels have become increasingly significant, resulting in diminished private sector participation. Current trade policies involving tariffs are expected to create immediate challenges, without substantial improvement in GDP performance.

The debt to GDP ratio shows a secular rising trend, says SBI.

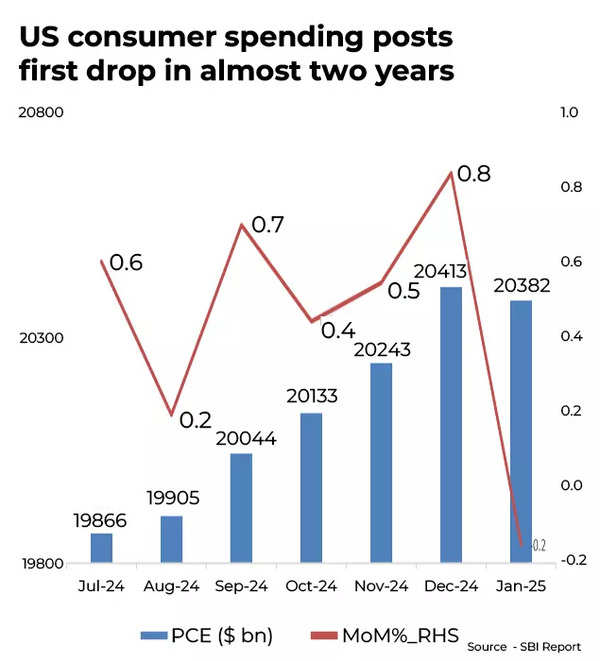

3) Reduced exports, consumption: Post-COVID US economic growth appears exceptional, attributed to extensive policy measures. Extended analysis suggests a probable decline in US economic growth, accompanied by reduced exports and consumption.

4) Savings to GDP ratio: Total factor productivity growth is diminishing, while value addition shows negative progression. Elevated wage levels might deter future investments. The savings-to-GDP ratio has reached its lowest point since 2011, marking the second-lowest figure since 1951.

January witnessed the first decline in consumer spending in nearly 24 months, whilst the goods trade deficit reached unprecedented levels due to businesses accelerating imports to avoid tariff implications, suggesting possible economic contraction this quarter. Consumer expenditure trends are expected to weaken in correlation with the projected overall GDP slowdown.

US Consumer Spending Drop

5) Stock market mayhem: The S&P 500 has given up its post-November election gains, with March 2025 projected to record the poorest monthly performance since the COVID-19 period.

US markets, including the S&P with a market capitalisation of approximately 52.9 trillion (February 2025), appear to have reached their limits after delivering exceptional returns. Investors are reassessing earnings forecasts amidst persistent volatility. The prominent ‘magnificent 7’ stocks display vulnerability following the Deep Seek event, with traditionally stable companies like Apple facing scrutiny of their safe-haven status, says the SBI report.

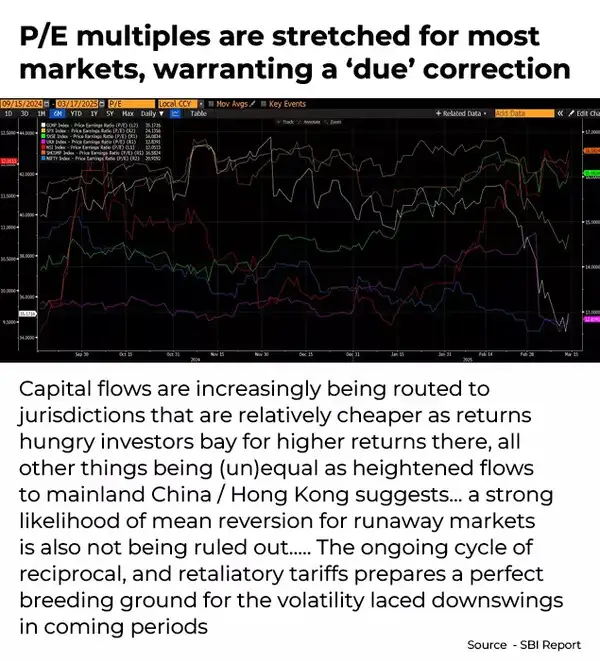

P/E multiples are stretched for most markets

Investment flows are shifting towards more affordable markets as investors seek enhanced returns, evidenced by increased activity in mainland China and Hong Kong markets. Analysts anticipate possible corrections in overvalued markets. The ongoing series of reciprocal tariffs creates conditions for increased market instability in forthcoming periods.

US economy: What’s the long-term outlook?

The SBI report says that positive structural adjustments could potentially elevate GDP trends. Despite modest productivity improvements, increased national savings could enhance potential GDP. Private sector re-engagement combined with technological advancements could boost growth prospects, though initial adaptation periods may present challenges. The SBI report notes the following:

- The US economy long-term trends in GDP indicate decline in potential GDP, demand and investments

- The US indebtedness has sharply increased over the years, crowding out the private sector

- Although high debt has not reflected in US dollar, which shows cyclical trends its strength has over the years has declined

- The current tariff policy will have short term pain and US GDP will not see acceleration in material way

- The economic rational of US DOGE is evident from long-term term trends

- If the structural adjustment gains traction, then potential GDP trend can see a upward shift. The larger national savings that come from exercise despite nominal improvement in productivity can still push the potential GDP up. The crowding in of the private sector that follows along with technical progress can add significantly to growth prospects. However, this adjustment will have short term costs.