India calling: Why top startups are moving back home – The Times of India

For years, many Indian startups chose to register their companies abroad — often in the US, Singapore, or even the Cayman Islands — to access global investors and funding. But now, a wave of reverse migration is sweeping through India’s startup ecosystem. Companies that once set up their legal headquarters overseas are moving back to India, a trend known as “reverse flipping”.

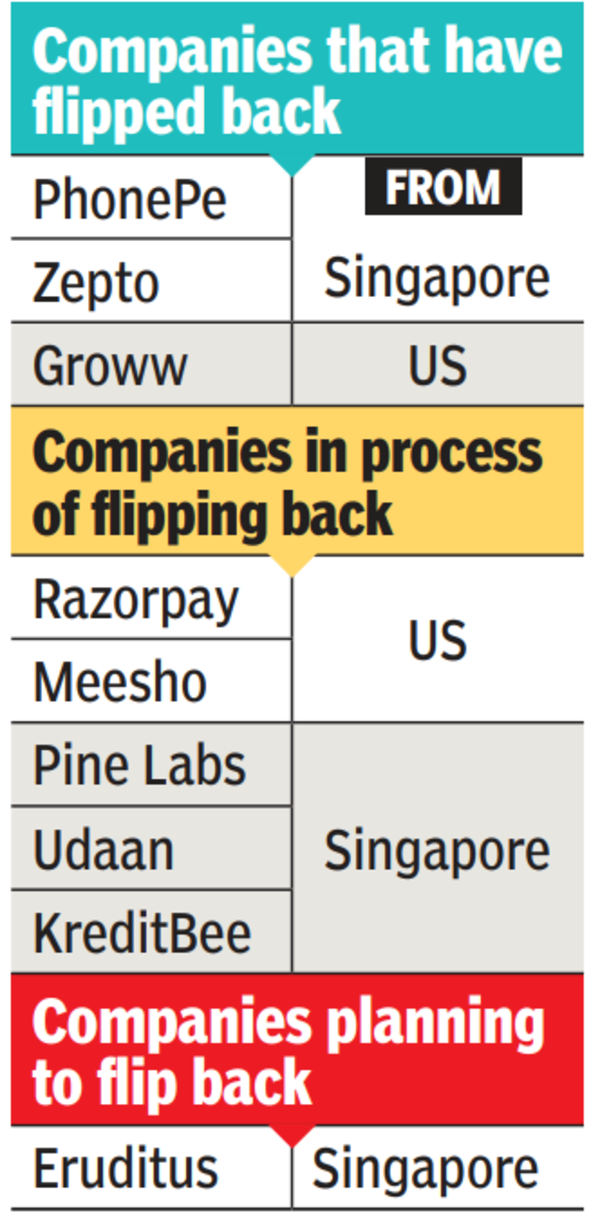

The list includes big names like Razorpay, Udaan, Pine Labs, and Meesho, with some, like Zepto, having already completed the process. The shift isn’t simple — firms have to secure multiple legal and regulatory approvals and make hefty tax payments. Yet, many are taking the leap, driven by the promise of better IPO prospects, streamlined compliance, and India’s booming economy.

Notwithstanding the current state of the secondary market, the Indian capital market has matured significantly for IPOs, offering an attractive alternative to global markets. According to Alok Bathija, Partner at Accel, a software company with $50-$60 million in revenue and stable growth can now list in India, whereas a similar listing in the US would require nearly $500 million in revenue. With Indian markets offering higher valuations and greater accessibility, more startups are seeing the advantage of returning home.

Rise Of Reverse Flipping

Beyond IPO aspirations, shifting back also simplifies compliance, especially for startups in highly regulated sectors like fintech. Many of these companies generate the majority of their revenue in India and operate primarily within its financial system, making it logical for them to align with Indian laws. Amit Nawka, Partner at PwC, explains that fintech startups, as they grow larger and play a bigger role in India’s financial landscape, naturally fit better within the local regulatory framework. “As far as fintechs are concerned, as they get larger and contribute to India’s financial system, it is appropriate for them to be headquartered here, and it also gives regulators a sense of comfort,” he said.

The trend is also being fuelled by the expansion of domestic funding options. Previously, Indian startups headquartered abroad had easier access to global investors, particularly US-based venture capital firms, which preferred to invest in companies domiciled within their jurisdiction. But that is no longer the case. According to Siddarth Pai, co-chair at the Indian Venture and Alternate Capital Association (IVCA), the rise of family offices and domestic venture capital funds has changed the game. “Not just the IPO-bound startups, but a whole host of other startups are looking to flip back to India, especially those in regulated areas. It becomes easier for a company to plan its expansion and get approvals for setting up new businesses if its parent company is regulated by RBI or Sebi,” he said. The abolition of the angel tax has further encouraged many startups to make the shift.

Impact On Indian Startup Ecosystem

Industry estimates suggest that more than 70 startups are currently in the process of reversing their domiciles, and at least 20 of them are major ecosystem players. However, around 500 Indian startups are still headquartered abroad, mostly in the US and Singapore. Among the most prominent companies to move back was PhonePe, which paid a stagger- ing Rs 8,000 crore in taxes to shift its registration from Singapore to India. Sameer Nigam, co-founder & CEO of PhonePe, emphasised that for a highly regulated company like theirs, being based in India was the most logical decision. “India is where we started, India is where we are focused, and India is where we will stay for decades,” he said.

The Indian govt has taken steps to reduce bureaucratic hurdles and speed up the process for startups looking to shift back. Previously, an overseas startup merging with its Indian arm required National Company Law Tribunal (NCLT) clearance, a time-consuming procedure. Now, only govt and RBI approvals are needed, making the transition faster and more efficient. The rally in Indian tech stocks has also dispelled the longheld myth that startups must list on NASDAQ to achieve significant valuations. “India is one of the most robust IPO markets globally. In the last year alone, India had the highest number of IPOs globally, and second in value to the US,” said Varun Malhotra, Partner at Quona Capital. In 2024, India had 327 companies listing on the market, versus 183 in the US and 125 in Europe and 98 in China.

The Future of Indian Startups

For startups like Razorpay, moving back to India was an obvious choice. The company is paying over $100 million in taxes to make the transition, but CEO and co-founder Harshil Mathur believes it’s worth it. “The process of going public in India is much more streamlined today, making it a natural choice for startups like ours to grow and thrive in one of the world’s most dynamic economies. For Razorpay, reverse flipping aligns us closer to our primary market. India understands what Razorpay does, and it just makes logical sense for us to list on the market where people know us,” Mathur said.

With India rapidly emerging as a global startup powerhouse, this trend is only expected to accelerate. Sunil Khaitan, head of the financing group at Goldman Sachs India, predicts the “trend (will) accelerate in 2025, further positioning India as a key hub for entrepreneurial activity and leading to increased capital market access.” As regulatory reforms continue and the domestic investment ecosystem strengthens, the era of Indian startups incorporating overseas may soon be a thing of the past.