Elon Musk’s empire shaken: Tesla tumbles, X crashes amid US recession fears – The Times of India

March 10 was a brutal day for Elon Musk-the world’s wealthiest person . Tesla’s stock took a sharp nosedive, his social media platform X (formerly Twitter) suffered widespread outages due to what he called a “massive cyberattack,” and protests against his leadership role (DOGE) in President Donald Trump’s administration continued across the US.

Driving the news

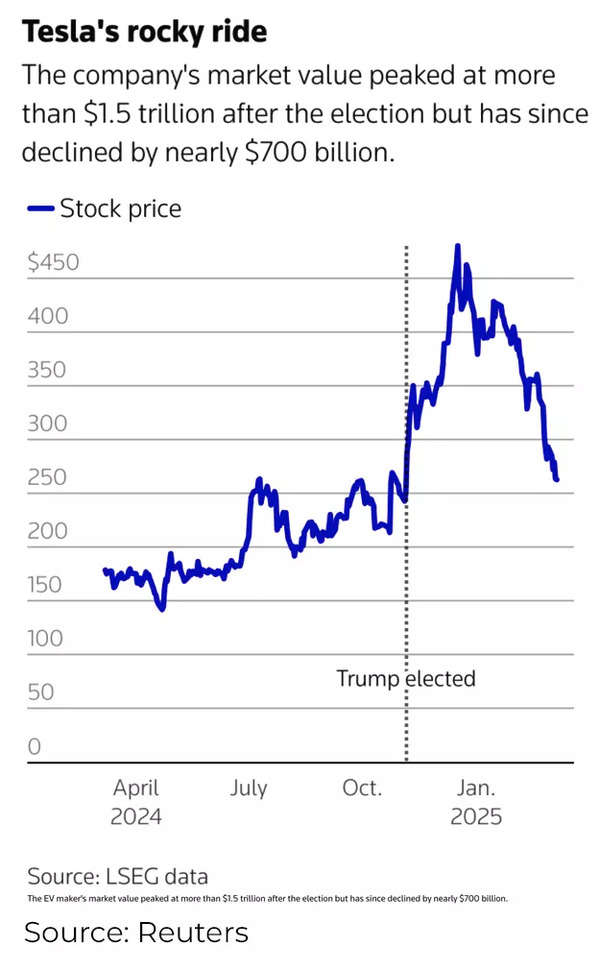

Tesla shares plunged more than 15% on Monday, extending their brutal year-to-date decline to nearly 45%, as investors worried about slowing sales, increased competition, and CEOElon Musk ’s growing political entanglements.- Adding to Musk’s woes, his social media platform X (formerly Twitter) suffered widespread outages, with tens of thousands of users reporting disruptions. Musk blamed a “massive” cyberattack that he claimed was likely orchestrated by a “large, coordinated group and/or a country.”

- The Tesla’s $125 billion market cap wipeout came amid a broader selloff in US stocks. In fact, these twin crises for Musk unfolded against a broader backdrop of market panic. The Nasdaq tumbled 4%, its worst single-day performance since 2022, while the S&P 500 and Dow Jones also fell sharply. Investors fear the Trump administration’s shifting stance on tariffs and economic policy could trigger a slowdown. Treasury Secretary Scott Bessent’s warning of a “detox period” as public spending is slashed only heightened those concerns.

- Tesla’s post-election rally has evaporated, with shares now trading 11% lower than they were on the day Trump won the presidency.

The big picture

Musk is facing mounting pressure on multiple fronts: Tesla’s declining sales, political backlash against his role in Trump’s administration, and growing skepticism over the company’s lofty valuation.

In Europe, Tesla sales have plummeted this year—down 71% in Germany, 45% in Norway, 44% in France, and 44% in Spain. In China, the company is losing ground to domestic competitors offering cheaper and more advanced electric vehicles. Even in the US, Tesla has resorted to aggressive discounts, low-interest financing, and free Supercharging to prop up demand.

Competition is heating up, with China’s BYD surpassing Tesla in EV sales and rolling out driver-assistance technology as a free feature—undercutting Tesla’s pricey Full Self-Driving (FSD) package.

- Tesla’s delivery numbers are trending downward, despite aggressive price cuts and financing incentives:

- Q1 deliveries are tracking for a 4% drop, according to Evercore ISI.

- Tesla has launched 0% financing deals and free Supercharging to stimulate demand.

- The Cybertruck launch has been rocky, with initial sales well below Musk’s estimates.

- Edmunds analyst Ivan Drury: “Tesla was already facing increased competition across all price points. Now, politics adds another layer of polarization.”

What they’re saying

- Investor Doug Boneparth on X: “Massive crash in Tesla stock. Musk will be fine. Retail investors? Not so much.”

- JP Morgan analyst Ryan Brinkman: “For how much longer can the stock remain divorced from the fundamentals?”

- Protest organizer Alex Winter (in Rolling Stone): “Detaching Musk from Tesla would be a meaningful blow against this administration … and a strike against what they hold most dear: money and power.”

To Republicans, Conservatives, and all great Americans, Elon Musk is “putting it on the line” in order to help our Nation, and he is doing a FANTASTIC JOB! But the Radical Left Lunatics, as they often do, are trying to illegally and collusively boycott Tesla, one of the World’s great automakers, and Elon’s “baby,” in order to attack and do harm to Elon, and everything he stands for. They tried to do it to me at the 2024 Presidential Ballot Box, but how did that work out? In any event, I’m going to buy a brand new Tesla tomorrow morning as a show of confidence and support for Elon Musk, a truly great American. Why should he be punished for putting his tremendous skills to work in order to help MAKE AMERICA GREAT AGAIN???

US President Donald Trump

Between the lines: The #TeslaTakedown movement and Musk’s political troubles

For years, Musk’s cult-like following helped insulate Tesla from market realities. But now, that aura is fading, especially as his deepening ties to the Trump administration alienate a growing segment of consumers.

Musk’s role as head of the Department of Government Efficiency (DOGE)—the administration’s controversial effort to slash federal agencies—has made him a polarizing political figure. His sweeping layoffs and budget cuts have sparked backlash, including nationwide protests at Tesla dealerships.

The #TeslaTakedown movement has gained traction on social media, urging Tesla owners to ditch their vehicles and investors to dump their stock. Protesters gathered outside Tesla showrooms in multiple cities over the weekend, with signs reading “Stop Musk’s Crime Spree” and “Elon is Trump’s Executioner.” Some Tesla owners have even defaced or covered up their car’s logo to distance themselves from Musk, the Axios report said.

Adding fuel to the fire, Musk himself has embraced right-wing rhetoric, frequently engaging with controversial figures on X. His political leanings, once seen as a sideshow, are now becoming a business liability. A growing number of consumers are rethinking their Tesla purchases, unwilling to support a CEO they view as aligned with the administration’s most extreme policies.

Even some investors are starting to wonder if Musk’s political involvement is distracting him from running Tesla. The company has fallen behind in key areas—its long-promised $25,000 car was quietly scrapped last year, while competitors like China’s BYD are racing ahead with innovations. Tesla’s recent focus on robot axis and AI-driven vehicles has yet to materialize into tangible revenue, making the stock’s once-lofty valuation harder to justify.

Musk’s response: ‘Always look on the bright side’

According to a report in Axios, even as his personal net worth took a $16 billion hit on March 10, Musk appeared unfazed.

Asked about Tesla’s struggles in a Fox Business interview, Musk laughed it off, quoting Monty Python: “Always look on the bright side of life!”

In the past too, Musk has quoted Monty Python.

His confidence has long reassured Tesla investors, but some are starting to question whether the optimism is still warranted.

X outage: Cyberattack or self-inflicted wounds?

- Musk has drastically cut X’s security staff since taking over Twitter, raising questions about whether the outage was due to a cyberattack—or simply self-inflicted infrastructure failures.

- Reports indicate that over 40,000 users were affected during peak outages.

- Cybersecurity experts say that while botnet attacks are common, Musk’s claim that Ukraine was involved is questionable without further evidence.

- Since Musk acquired X, the platform has suffered multiple technical issues—leading some analysts to blame underinvestment in infrastructure.

What’s next?

Tesla’s path forward is uncertain. While Musk insists the company will be fine long-term, it faces serious short-term challenges:

Can Tesla reverse its sales slump? Musk has promised a $25,000 EV, but no firm timeline exists.

Will political backlash grow? The #TeslaTakedown movement is planning more protests, and some Tesla owners are even selling their cars in protest.

How will tariffs impact Tesla? Trump’s looming trade war with China and Europe could further hurt Tesla’s supply chain.

Can Musk stabilize X? With user engagement already declining, continued outages and security concerns could push advertisers and users away.

Tesla’s stock has always defied gravity—but for the first time in years, investors are wondering whether Musk’s magic is wearing off.

(With inputs from agencies)