Elon Musk to Jeff Bezos, billionaires who attended Donald Trump’s inauguration face $209 billion loss – The Times of India

When Donald Trump was sworn in as the United States President on January 20, he was surrounded by some of the globe’s most affluent individuals. The billionaires in attendance – including Elon Musk, Jeff Bezos and Mark Zuckerberg – were at their peak wealth, benefiting from robust stock market performance.

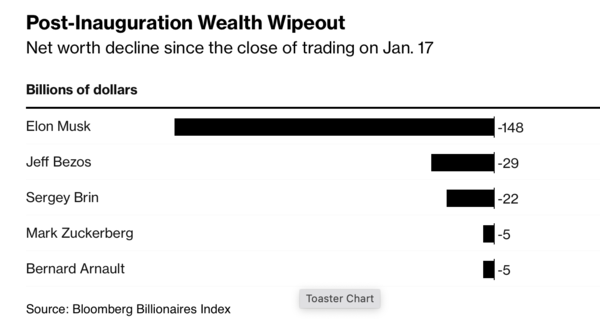

However, after seven weeks, circumstances have shifted dramatically. The commencement of Trump’s second term has resulted in significant financial setbacks for five billionaires who were present at the Capitol Rotunda, with their combined wealth declining by $209 billion, as reported by the Bloomberg Billionaires Index.

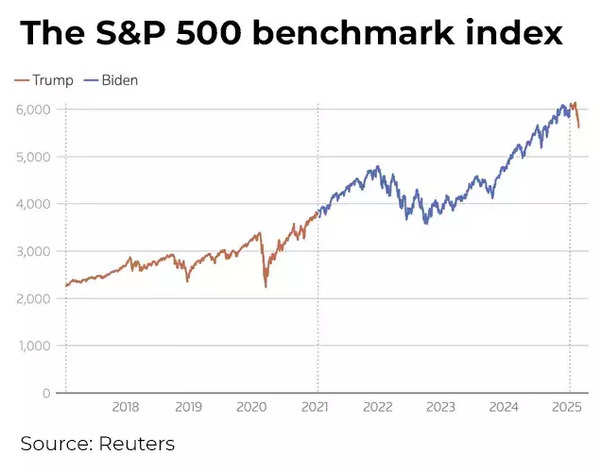

The interval between Trump’s election and inauguration proved profitable for the world’s wealthiest individuals, with the S&P 500 Index reaching numerous record highs. Investors were drawn to equity and crypto markets, anticipating business-friendly policies under Trump.

S&P 500 benchmark index

Musk’s Tesla Inc. experienced a 98% increase post-election, achieving a record high. Arnault’s LVMH rose 7% in the week preceding Inauguration Day, increasing the French businessman’s wealth by $12 billion. Zuckerberg’s Meta Platforms Inc., despite banning Trump in 2021, gained 9% before the new term and an additional 20% during his first four weeks in office.

who owns stock market wealth

However, expectations of continued market growth under Trump’s new term have been disrupted. The S&P 500 has decreased by 6.4% since his inauguration, with government employee redundancies and uncertainty regarding tariffs affecting equities, leading to a 2.7% decline on Monday.

Post-Inauguration wealth wipeout

The corporations associated with the inauguration attendees have experienced substantial losses, with their combined market value dropping by $1.39 trillion since January 17, the final trading day before the inauguration. Here’s an examination of these fortunes:

Elon Musk (down $148 billion)

Tesla CEO Elon Musk, 53, saw his net worth reach a record $486 billion on Dec. 17, the highest ever recorded on Bloomberg’s wealth index. His wealth surge was largely driven by Tesla’s stock, which nearly doubled post-election. However, Tesla has since lost all those gains, with European consumers turning away due to Musk’s political affiliations. In Germany, Tesla sales plunged over 70% in early 2024, while Chinese shipments fell 49% last month—the lowest since July 2022.

Jeff Bezos (down $29 billion)

Bezos, 61, who earlier clashed with Trump over the postal service and his ownership of the Washington Post during the president’s first term, congratulated Trump the day after the election on Musk’s X. Not only this, Amazon donated $1 million to Trump’s inauguration fund in December, and Bezos dined with the president last month, the same day that Bezos announced that his newspaper will prioritize personal liberties and free markets in its opinion section. Amazon shares have fallen 14% since Jan. 17.

Sergey Brin (down $22 billion)

Brin, aged 51, a co-founder of the original Google alongside Larry Page, maintains a 6% ownership stake. He participated in demonstrations at San Francisco airport in 2017, opposing the Trump administration’s immigration measures. Following Trump’s re-election in November, Brin attended a dinner with him at Mar-a-Lago in the subsequent month. In early February, Alphabet Inc. experienced a significant share price decline of over 7% after failing to meet quarterly revenue projections. Recently, Alphabet’s representatives, whilst facing pressure from the Justice Department regarding the potential break-up of its search engine operations, engaged in discussions with government officials, requesting a more moderate approach.

Mark Zuckerberg (down $5 billion)

Meta emerged as the top performer among the Magnificent Seven technology companies in early 2024. Whilst these influential companies, which have driven substantial gains in the S&P 500 index over recent years, showed stagnant performance, Meta achieved a 19% increase between mid-January and mid-February. However, the company subsequently relinquished these advances. The Magnificent Seven index has experienced a 20% decline from its peak in mid-December.

Bernard Arnault (down $5 billion)

Arnault, aged 76, whose family controls the luxury group that owns prestigious brands such as Louis Vuitton and Bulgari, has maintained a long-standing friendship with Trump spanning decades. He conversed with the then-candidate the day following the Pennsylvania assassination attempt in July. LVMH shares, after showing a downward trend through most of 2024, experienced a significant rise of over 20% from the election period until late January. However, the company has subsequently lost the majority of these gains. According to Morningstar analysts’ statement last month, a potential tariff ranging from 10% to 20% on European luxury goods could adversely affect sales, which are already experiencing difficulties.